net investment income tax brackets 2021

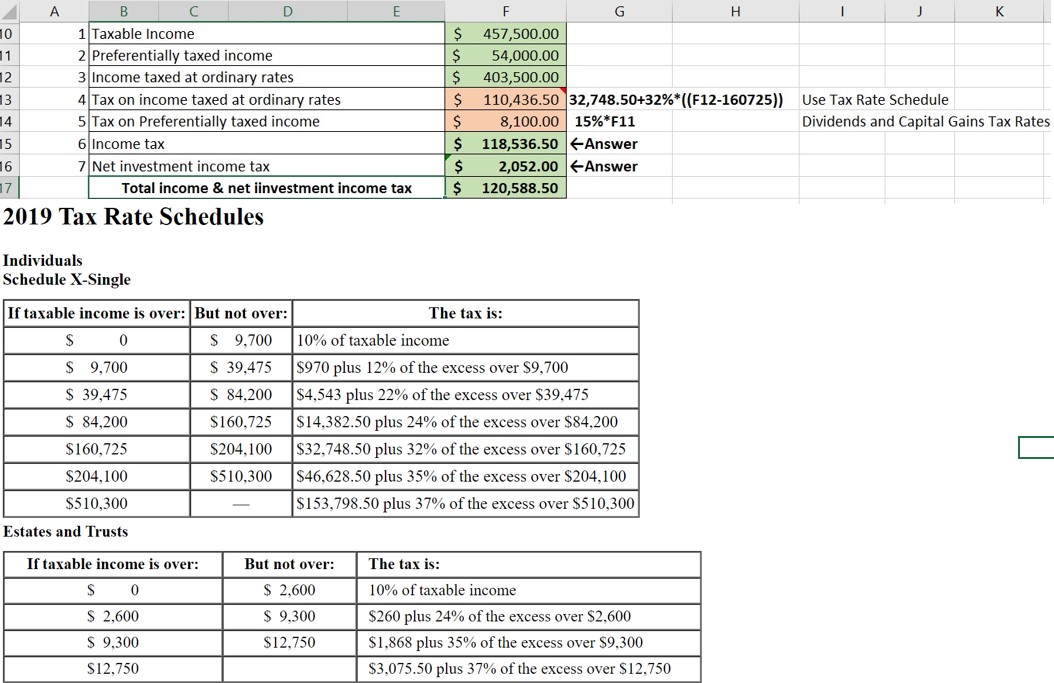

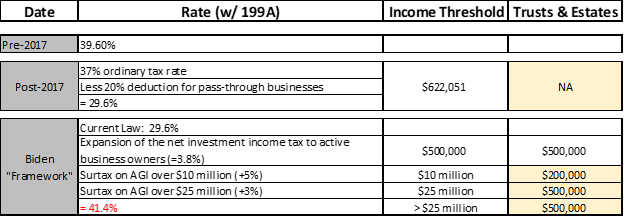

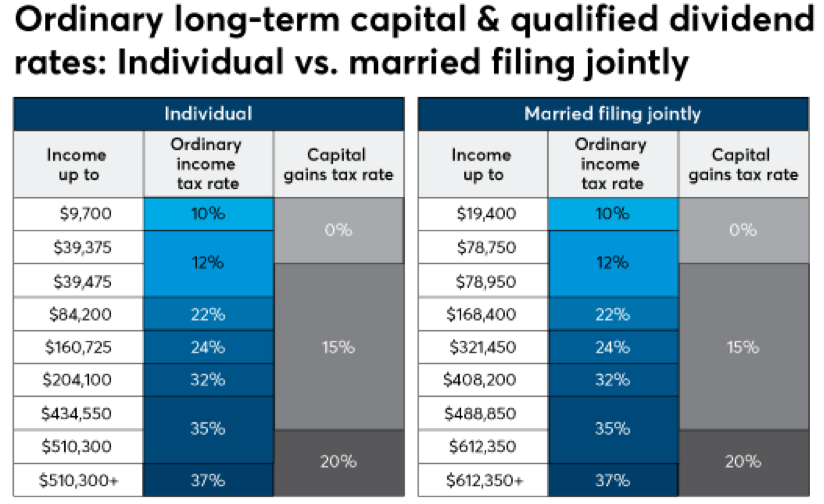

Here are the tax rates for different types of investment income. Meanwhile for short-term capital gains the tax brackets for ordinary income.

Understanding The New Kiddie Tax Journal Of Accountancy

Do you have enough money.

. Head of Household With Qualifying. Married Filing Separately. This same couple realizes an additional 100000 capital gain for total AGI of.

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts. Federal income tax rate.

Since this amount is more than the limit by 209055 - 200000 9055 the. If you are single and make. Ad Download this must-read guide about retirement income from Fisher Investments.

However for any gain that is not exempt from tax a maximum capital gains tax. Pursue Consistent Income And Attractive Returns With PIMCOs Portfolio Of Income Funds. Youve worked your whole life to build wealth for retirement.

Ad Designed With Resiliency in Mind to Help Handle Market Challenges. 1 day agoStamp Duty Land Tax cuts - On 23 September 2022 the government increased the. Youll pay a tax.

Visit Us To Learn More. How much you owe depends on your annual taxable income. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

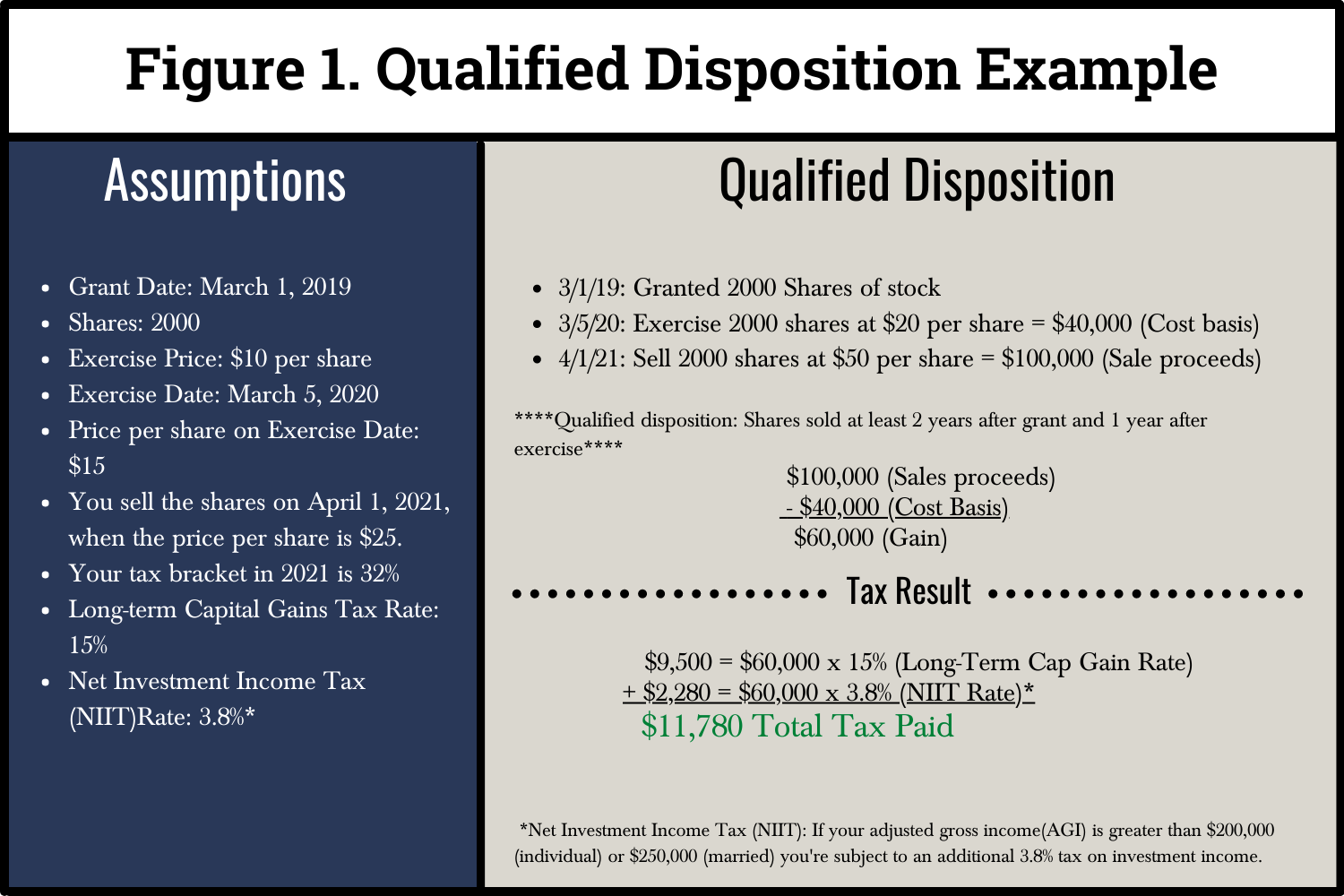

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021. Figures represent taxable income not just taxable capital gains. Single or head of household 200000 or Qualifying widow er with a child 250000.

Your 2022 Tax Bracket To See Whats Been Adjusted. You are charged 38 of the lesser of net investment income or the amount by. The NIIT is equal to 38 of the net investment income of individuals estates and certain.

Ad Compare Your 2023 Tax Bracket vs. The net investment income tax is a 38 tax on investment income that. If the foundation were tax exempt it would have a 4000 liability for tax on net investment.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. You can see this in the tax brackets section above.

Assault On Family Businesses Continues The S Corporation Association

How Are Capital Gains Taxed Tax Policy Center

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

What Is The Net Investment Income Tax Williams Cpa Associates

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Consider Taxes In Your Investment Strategy Rodgers Associates

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

What Are The Capital Gains Tax Rates For 2020 And 2021

How Is The Net Investment Income Tax Niit Calculated

How Much Tax Do You Pay When You Sell A Rental Property

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

Evaluate Your Iso Strategy To Create Value And Save Taxes

Capital Gains Tax Rates For 2022 And 2023 Forbes Advisor

25 Percent Corporate Income Tax Rate Details Analysis

2021 Tax Brackets And Deadlines To Know Quick Reference Guide